1 Introduction

A fundamental building block for the success of structural reforms, especially in countries with fragile institutional frameworks as the Republic of Moldova, is the complementarity of reforms. It means that, instead of solo approach in promoting reforms with limited inter-institutional coordination or, even worse, which involve even competition among institution, reforms should fuel one each other, creating virtuous cycles. One relevant example is the potential interplay between two seemingly unrelated reforms: reform of the state-owned enterprises’ (SOEs) sector and the capital market reform. Both are on the current government’s agenda. Namely, in 2022 the Government adopted the State Ownership Policy, which laid the ground for the SOEs’ reform: fostering the corporate governance of SOEs, classification of companies into those eligible and non-eligible for privatization (the so-called triage), adoption of the principle of competitive neutrality and restructuring the institutional framework for management of SOEs – measures that are in line with the World Bank and OECD corporate governance principles for SOEs (World Bank, 2014; OECD 2015; World Bank 2017). Also, currently, the capital market strategy is being drafted that envisages the increase of the number of financial instruments, issuers of financial instruments, investors and modernization of the capital market infrastructure.

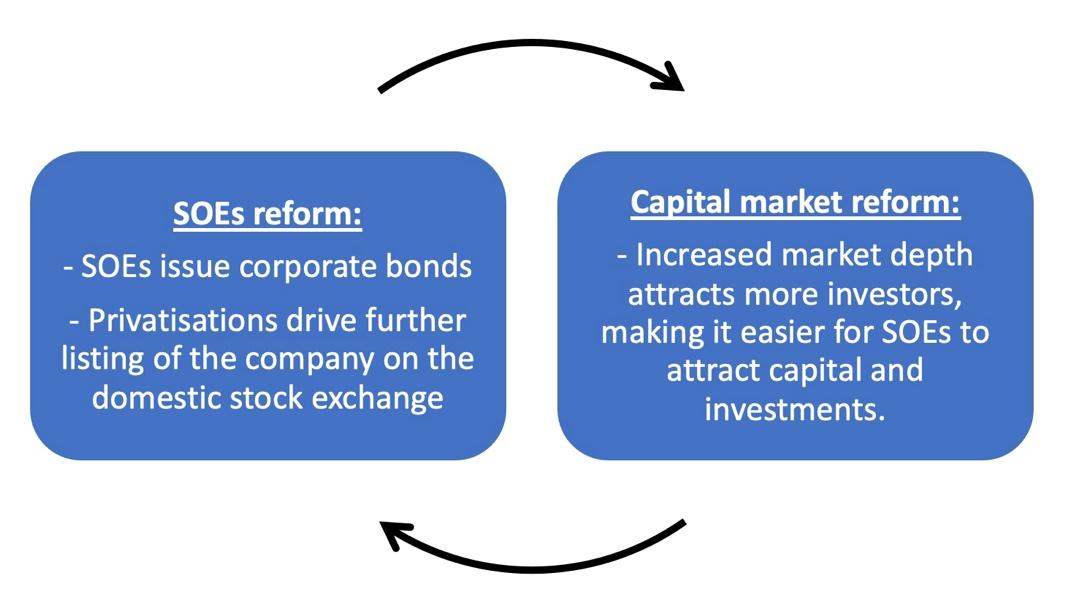

Despite being seemingly unrelated, the SOEs’ and capital market reforms and work together by reinforming each other and, in this way, speeding up the achievement of reform objectives. More specifically, the SOEs can contribute to boosting the development of the domestic capital market in two ways: (i) by issuing corporate bonds, boosting the supply of financial instruments; and (ii) by listing of minority shares through the domestic stock exchange. It will will contribute to boosting the supply of financial instruments, will incentivize the development of the capital market infrastructure and will increase the popularity of investing in domestic capital market among local investors, which will further support SOEs and the economy in general, by ensuring access to additional financing sources for development.

Creating a virtuous cycle between SOEs and capital market reforms will help addressing the specific challenges of each sector: poor corporate governance of most SOEs that causes its underperformance compared to the private sector in terms of profitability and efficiency indicators on the one side, and low capital market depth with limited number of issuers and financial instruments on the other side.

Hence, the scope of this paper is to describe the opportunities of creating the synergy between the SOEs’ and capital market reform and measure the potential of SOEs to issue corporate bonds and be listed on the domestic stock exchange, based on the analysis of their financial statements, legal framework and overall macroeconomic context in the Republic of Moldova. The paper formulates a series of concrete policy recommendations for the short-, medium- and long-run in order to facilitate the development of the capital market through the SOEs’ reform.

2 General and Specific Context Analysis

2.1 State Owned Enterprises

The SOEs reform is currently on the Government’s agenda, being also part of European integration agenda. Namely, the Action Plan for carrying out the 9 recommendations identified in the European Commission opinion from June 2022 contained a series of strategic measures related to:

- the adoption of the State Ownership Policy that should cover principles, measures and actions concerning better corporate governance, reorganization, privatization, and liquidation of non-viable companies;

- implementation of the policy on state ownership including through the final adoption of the adjusted laws on public-private partnership and public property management (step 4) and reinforce public procurement;

- improvement in the regulatory framework on corporate governance of state-owned enterprises / companies with majority state capital, in line with the principles of the Organization for Economic Cooperation and Development (OECD), including regulations on selection and appointment of members of board of directors and of audit committee of state-owned enterprises and on the rules for their remuneration.

Additionally, in the context of the Republic of Moldova obtaining the EU candidate country status for accession to the European Union, the European Commission published, in November 2023, the detailed Report on Moldova regarding the progress, challenges and recommendations for the accession process (Republic of Moldova 2023 Report, Commission Staff Working Document). Thus, under the “Fundamentals” cluster (the most important cluster of chapters of the accession negotiations process that is first to be opened during the negotiations and last one that marks the close of negotiations for EU accession), the European Commission included a specific recommendation related to the SOEs’ sector: “continue to improve the business environment, reduce state interference in pricing, and maintain a rapid pace of reforms to restructure and/or privatize state ownership.”

According to the independent monitoring reports of civil society organizations (Expert-Grup, IPRE and LRCM, 2023), the progress in implementation of these commitments was mixed. The Government approved the State Ownership Policy in 2022 (Government Decision no. 911/2022), which laid the ground for a comprehensive reform of the SOEs’ sector in line with the OECD and World Bank corporate governance principles. It included a number of strategic measures related to ensuring competitive neutrality of SOEs, delimitation of SOEs that should be exposed for privatization and those that should remain in state ownership, fostering the institutional framework for ensuring a proper supervision, regulation and monitoring of SOEs, enhancing the corporate governance of SOEs by increasing the level of independence and professionalism of boards, increasing the transparency of SOEs etc. Nevertheless, the Program for implementation of the State Ownership Policy has been drafted only in 2024, and most of measures and reforms planned in the State Ownership Policy in 2022 remained on paper.

Another independent monitoring report (Expert-Grup, 2024), provided a moderate evaluation (3 out of 5 points maximum) the reforms in the SOE sector. According to this report, the main evolutions were:

- In October 2023, by the GD no. 819/2023, the screening mechanism for state enterprises and commercial companies with state capital was approved.

- On April 12, 2024, the Ministry of Economic Development and Digitization published for public consultation the draft Programme on the administration of public state property for the years 2024-2027.

- In October 2023, the analysis of the functional alignment of the organizational structure of the Public Property Agency

was published in order to facilitate its reorganization. - For the digitization of the records and administration of state property, in November 2023, the Government approved the Concept and Regulation of the “Register of public patrimony and administration of state property” integrated information system.

Nevertheless, the report mentioned above points on a number of constraints revealing the slow pace of the SOE reform:

- The organizational structure of the Public Property Agency is not aligned with its functional duties, which undermines a proper enforcement of good governance principles in SOEs.

- The records and administration of public property are not digitized, which hampers the transparency about state ownership and the efficiency of regulating this sector.

Other constraints are related to the poor quality of corporate governance of SOEs, induced, among others, by the fact that the majority of board members are public officials, with almost no independent board members, which exposes the SOEs to political interference and operational inefficiency. This is mainly revealed by the underperformance of SOEs compared to the private sector.

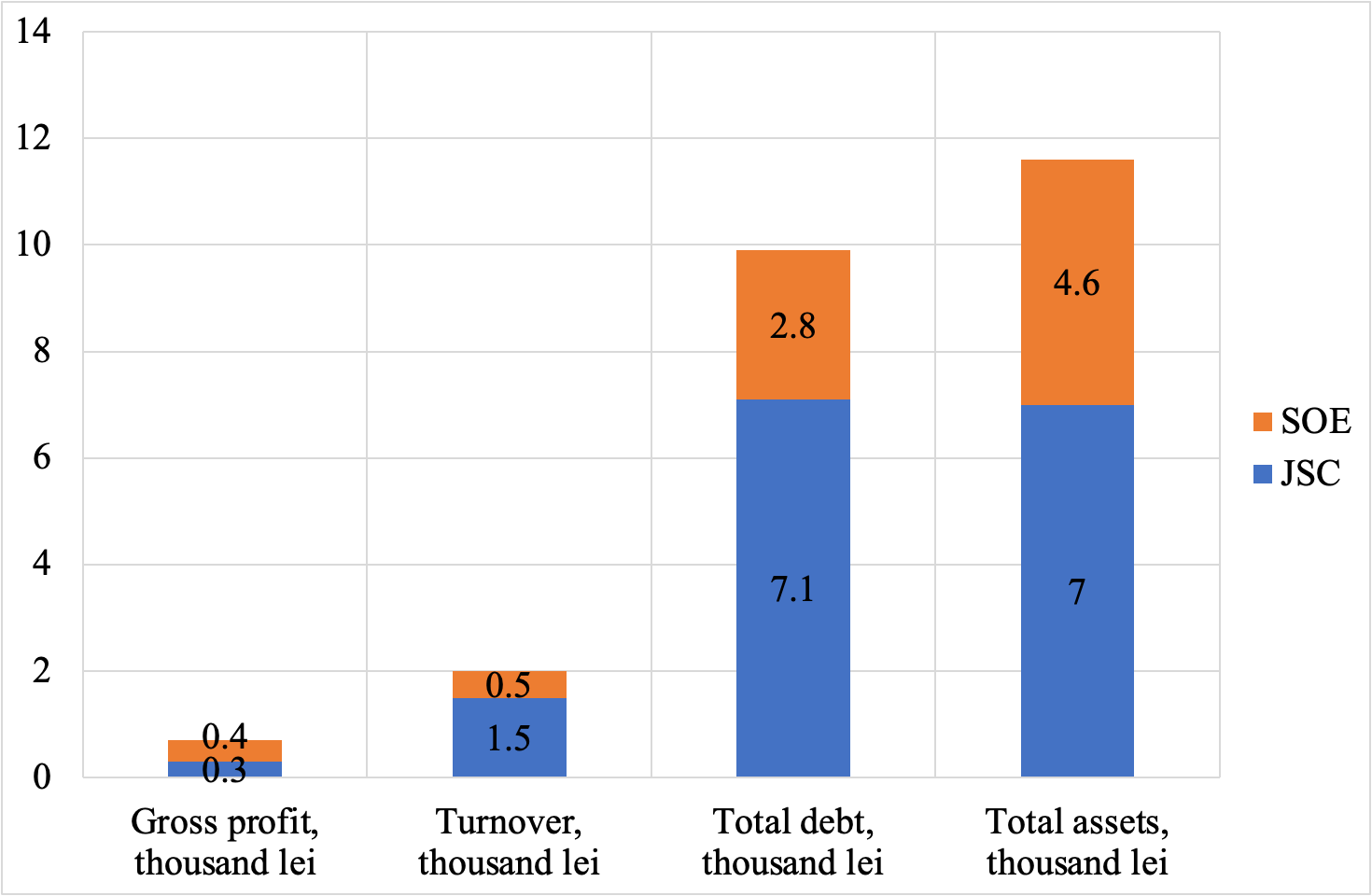

The analysis (Lupusor, 2024) of the economic and financial indicators of SOEs, administered by the Public Property Agency, reveals major shortcomings in their efficiency. While the share of assets held by SOEs in total assets held by the companies in 2022 amounted to about 11.7% (7.1% held by joint-stock companies (JSCs) with majority state capital and 4.6% held by state-owned enterprises (SOEs)), the share of sales revenues was much lower – only 2% (1.5% by JSCs and 0.5% by SOEs). The share of profits recorded by SOEs in the total profits reported by companies in 2022 was even lower – only 0.7% (0.4% by SOEs and 0.3% by SA). In addition, SOEs also recorded a significant share of total debts reported by companies: 9.9% in 2022 (7.1% reported by JSCs and 2.8% reported by SOEs), which, against the background of low profitability and efficiency, reveals a series of risks (see Figure 1). The efficiency shortcomings are also revealed by the major discrepancies in the rates of return calculated for SOEs compared to the rest of the economy. Thus, in 2022, the average rate of return on assets for SOEs was only 0.1% and -1% for JSCs, compared with 7.1% for the rest of the enterprises; the average rate of return on sales for SOEs was only 14.8% and -4.9% for JSCs, compared with 20.8% for the rest of the enterprises. Liquidity indicators, likewise, were weaker in the case of SOEs compared to the rest of the enterprises: the current liquidity ratio (current assets/current liabilities) in 2022 reported by SOEs was 1.7 and 1.2 in the case of JSCs, compared to 3.0 for the rest of the enterprises

Figure 1. Financial indicators reported by SOEs, share of SOEs assets in the rest of the companies, year 2022

Source: Public Property Agency and National Bureau of Statistics

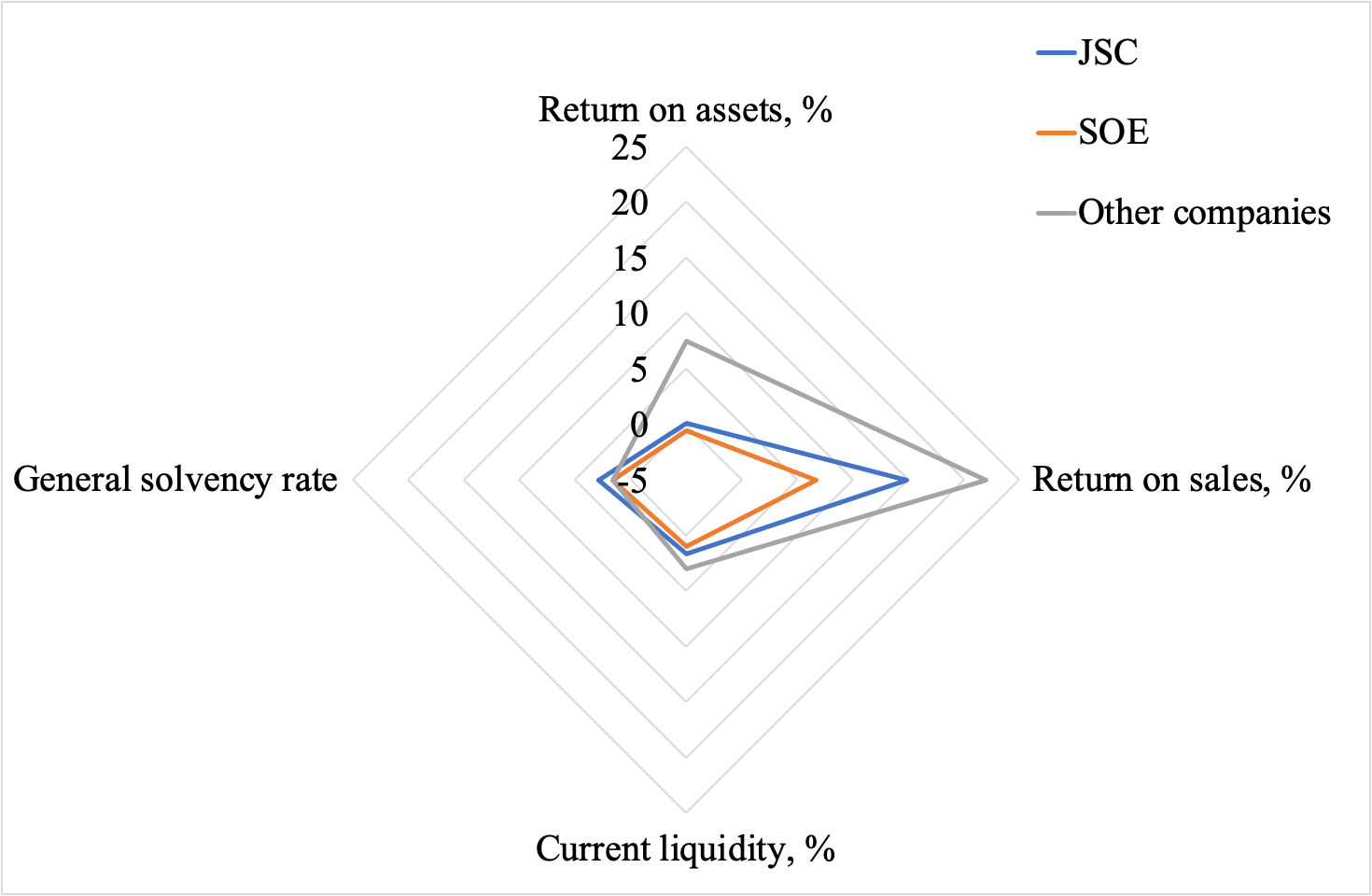

Therefore, SOEs, in addition to being much more inefficient compared to the rest of the enterprises, also face the critical problem of financial means for development. However, the above-mentioned fact does not suggest solvency problems: the overall solvency ratio (total assets to total liabilities) in 2022 was better for SOEs compared to the rest of enterprises (2.9 compared to 1.7) and similar for JSC and the rest of companies (Figure 2).

Figure 2. Financial indicators reported by SOEs compared to the rest of the companies, year 2022

Source: Public Property Agency and National Bureau of Statistics

Capital market

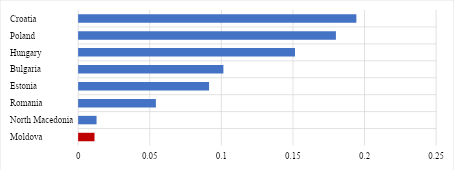

The capital market in Moldova is characterized by a low depth, being marked by limited number of financial instruments, issuers of financial instruments and poor infrastructure. According the IMF data, Moldova has one of the lowest Financial Market Depth Index in the region (figure 3). According to a recent report (CEELM, 2023), the capital market in Moldova is underdeveloped. Among the factors determining the low level of the Moldovan capital market development are the absence of liquid financial instruments, lack of institutional investors, and low degree of confidence in investing in financial instruments.

Figure 3. Financial market depth index, 2023

Source: IMF, https://data.imf.org/?sk=388DFA60-1D26-4ADE-B505-A05A558D9A42&sId=1479329132316

The interplay between SOE and capital market reforms

Both reforms can reinforce each other, by creating a virtuous cycle development cycle. Namely, there could be identified a number of SOEs with relatively robust financial position and attractive investment projects that could serve as frontrunners in issuing corporate bonds. Also, some SOEs could list on the domestic stock exchange the minority packages of shares, by attracting portfolio investors among firms and population. This could be done either after the privatization of majority shares of the respective SOEs (the government lists on the domestic stock exchange package of share that remained in its ownership after the majority is privatized), or listing of minority shares can be made for the SOEs that will remain in state ownership (in case of strategic SOEs that are not eligible for privatization).

Both strategies (corporate bond issuance and listing on the domestic stock exchange) can boost the capital market by increasing the number of financial instruments and issuers of financial instruments (corporate bonds market should serve as booster of the overall capital market development, following the experience of most European countries). Additionally, it will bring more investors on the market, increasing its liquidity and attractiveness for other listings and issuances of financial instruments. Importantly, the participation of SOEs on the capital market will support the processes of strengthening the transparency and governance of enterprises, which is a fundamental condition of success on this market (investors will be unlikely to invest in bonds or stocks of companies with issues with transparency and governance). In its turn, a more developed capital market will facilitate the access of other SOEs (and enterprises from the private sector) to financing their operational and investment activity, generating more development opportunities).

Figure 4. How SOEs and Capital market reforms can enable each other?

Source: author

3 Potential of SOEs in issuing corporate bonds and listing on the domestic stock exchange

The potential of SOEs to issue corporate bonds is analyzed through three different dimensions: (i) legal; (ii) governance; and (iii) financial perspective.

From the legal perspective, the Law no. 171 of 11.07.2012 on the capital market allows the issuance of corporate bonds by joint-stock companies and limited liability companies (implicitly, those with state owned capital). There are four key conditions in this regard: (a) The value of corporate bonds + interest + any other commissions should not exceed 90% of shareholders’ equity; (b) shareholders equity should be min. 1 mil. MDL; (c) the company should be operational for min. 3 years and register net profit for the last 2 years; and (d) no cases of unmet obligations against related to other bonds. To which extend the financial conditions are met we will see below, but from the legal perspective, there environment is conducive for SOEs’ bonds issuance.

From the governance perspective, the situation is more complicated. The reason is that not all SOEs are joint-stock or limited liability companies and, hence, are not eligible to issue corporate bonds. Namely, out of 83 active SOEs administered by the Public Property Agency, only 29 are joint stock companies (SA) and 1 – limited liability company (SRL), the rest being “intreprinderi de stat”, which are yet to be restructured into SA after property delimitation. Another problem is that almost all board members are public officials, making the boards and, implicitly, SOEs, politically exposed. There is an ongoing reform on bringing in independent board members, but lack of financial incentives is a major issue in this regard.

From the financial perspective, the analysis of financial statements of SOEs that are joint stock (SA) or limited liability companies (SRL), reveals that entities have a comfortable leverage ratio: the average total-debt-to-asset ratio in 2022 was only 0.39 (39% of assets are financed from debt, the rest being the shareholders’ equity). In fact, if we exclude CET Nord, FEE Nord and Termoelectrica, which are the most indebted SOEs, the leverage ratio is even lower – 0.27 (Moldovagaz was excluded from the analysis because the Government of Moldova does not own the majority share package). Such a low level of indebtedness points on a high flexibility and potential in attracting additional capital through corporate bonds issuance. On the downside, the efficiency and profitability of most SOEs is lower compare to the private companies: out of 30 SOEs (SA + SRL) managed by PPA, only 19 registered positive net profit in 2022, but the total net profit among all 30 SOEs was negative (net losses exceeded net profits). Also, the return on assets (ROA) was only 0.07% compared to 7.5% for the private companies. All in all, while the leverage ratio allows SOEs to issue bonds, the main challenge is improving the efficiency and profitability of these companies.

At the current stage, the analysis shows that only few SOEs can serve as frontrunners for issuing corporate bonds, as the majority struggle with corporate governance, efficiency and profitability issues.

Still, few SOEs can be considered well-suited to be the first in issuing corporate bonds (table 1), due to low leverage ratio (high potential to issue relatively large volumes of bonds), high capital adequacy (all SOEs are funding their activity mainly from shareholders’ equity), high short-term liquidity and limited credit risk, as well as positive profitability (but more should be done to increase efficiency and profitability indicators).

Table 1. SOEs that could be the first issuers of corporate bonds, according to data of 2022

| SOE | Equity | Leverge ratio | Return on assets (ROA) | Return on sales (ROS) | Current liquidity ratio (current assets/short-term debt) | Potential of bond issuance |

| Barza Alba | 345.5 mln. MDL | 0.11 | 2.08% | 44.9% | 10.7 | 150 mln. MDL |

| Energocom | 8036.9 mln. MDL | 0.34 | 1.17% | -0.74% | 14.5 | 1.9 bln. MDL |

| Loteria Nationala a Moldovei | 211.5 mln. MDL | 0.28 | 57.7% | 4.5% | 3.4 | 63 mln. MDL |

| Moldtelecom | 4250.6 mln. MDL | 0.19 | 0.76% | 18.1% | 5.2 | 1.6 bln. MDL |

| RED Nord | 2637.7 mln. MDL | 0.12 | 2.32% | 14.9% | 8.6 | 1.1 bln. MDL |

| Tracom | 67.7 mln. MDL | 0.01 | 2.53% | 35.6% | 78.6 | 33.4 mln. MDL |

| Arena Nationala | 834.5 mln. MDL | 0.38 | 1.32% | 55.9% | 2.6 | 161.4 mln. MDL |

| Franzeluta | 249 mln. MDL | 0.21 | -6.09% | 13% | 4.9 | 92.3 mln. MDL |

Source: Author’s estimations

Benefits of corporate bonds’ issuance by SOEs

As described the interplay between the SOEs and capital market reform, the potential issuance of SOE corporate bonds can be beneficial both for SOEs and capital market. From the capital market perspective, it will provide an important boost to the market of corporate bonds, which should become a fundamental element of the domestic capital market, as there will be additional financial instruments and issuers of financial instruments of the market. Respectively, other companies will follow the frontrunners who will prove in practice that corporate bonds allow to attract capital at better conditions compared to bank loans. It will lead to increased financial market depth and development.

The benefits for SOEs are manyfold. First, the corporate bonds will ensure larger access of SOEs to financing sources at relatively convenient conditions. For example, judging on the empirical experience with municipal bond issuance (Expert-Grup, 2024), bonds, be it municipal or corporate, can ensure lower interest rates compared to bank loans. Taking into account that the interest rate for municipal bonds for 2-3 years range at about 1-1.5 p.p. + T-bills of 1 year, the risk premium in the case of SOEs should comparable. Hence, the estimated interest rate of an SOE 2-year bond issued in 2024 could be at around 6.0-6.5% (flexible rate), which is lower compared to the average interest rate on corporate loans (app. 8-9%). Other benefits are related to cash flow, because in the case of bonds, unlike the bank credit, the principle is paid at maturity, making the coupon total payments lower compared to total costs of servicing a loan. In addition, corporate bonds provide the opportunity to get funding for investment projects that could not be funded by banks because of lower risk tolerance of banks compared to the capital market. Last, but not least, it provides the possibility to improve the public image, as a frontrunner of bond issuance, as well as due to the positive implications the bond issuance have on the transparency and governance of the issuer.

Additional opportunity – listing on the domestic stock-exchange

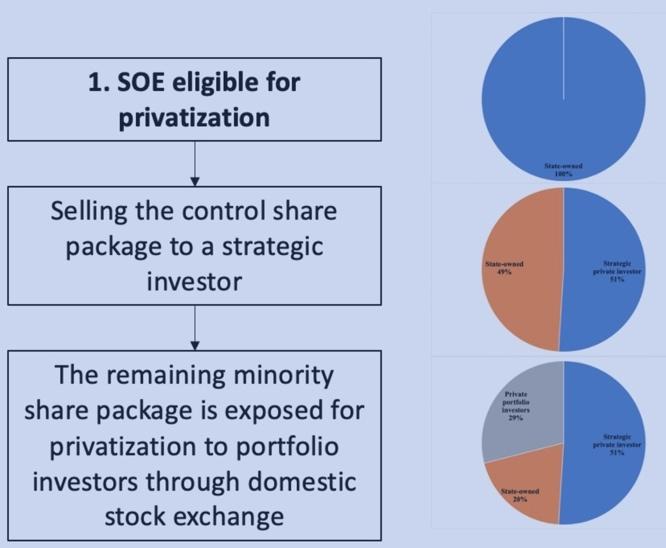

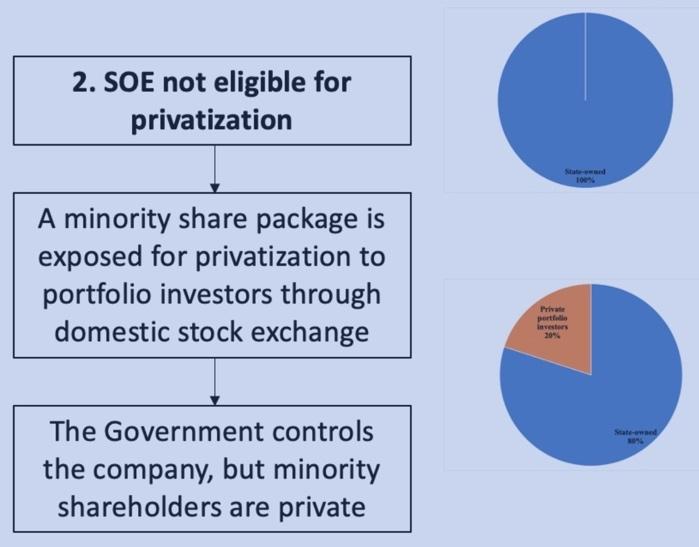

Besides bond issuance, an additional opportunity to boost the capital market through SOE reform is the listing of minority shares of SOEs on the domestic stock-exchange. The listing can be done in two cases. First case is related to SOEs that are eligible for privatization – listing following the privatization of the control package of shares by a strategic investor. In this case, the Government can list minority package of shares on the domestic stock exchange in order to attract portfolio investors and boost the equity market. Listing

after privatization to a strategic investor can be at a higher price, implying better outcomes for the Government, because the portfolio investors will tend to follow the strategic investor. The second case is related to SOEs that are not eligible for privatization. In this case, the Government can list a minority package of shares, while preserving the control package, in order to bring in portfolio investors and boost the equity market (figure 5).

|

|

Figure 5. Two cases of SOEs’ listing on the domestic stock exchange

Source: Author

4 Conclusions and ways forward

The analysis revealed that SOEs can serve as instruments to boost the capital market, at least from two perspectives: (i) selected SOEs can become frontrunners in issuing corporate bonds that could contribute to the development of the bonds’ market and provide access to more convenient financing sources; and (ii) SOEs can list minority packages of shares on the domestic stock exchange, either after the privatization to a strategic investor or in the case of SOEs where the Government will preserve the control package, in order to boost the equity market. Both approaches will contribute to the capital market development, while ensuring larger access for SOEs to financing and development opportunities. Given the fact that many SOEs have sufficient capital adequacy and low level of indebtedness, the issuing of corporate bonds and listing of SOEs provide feasible opportunities to unleash the potential of both of the SOEs’ sector and the domestic capital market, which can boost the overall economic development of the Republic of Moldova.

In order to explore these opportunities, the following actions and policies should be carried out:

On the short-term (immediate actions)

- Identification of the SOE(s) (at least 1 SOE) to serve as frontrunner(s) of the corporate bond issuance.

- Identification and formulation of the investment project to be financed from the bond issuance that would be convincing for potential investors: project with clear impact on the company development, its profitability and economic development of the entire country.

- Strengthening the corporate governance of the identified SOE(s): attracting independent board members, improving the website of the company, increasing the transparency of the company by publishing as much information as possible, running a financial audit of the SOE(s) by reputable auditing company (if the financial statements have not been audited for the last year), revising the KPIs of the SOE management and the procedures to monitor the KPIs, revising the code of ethics and ensuring all the necessary internal governance procedures to enforce integrity.

- Identification of a reputable financial intermediary (preferably, a commercial bank) with experience in intermediation of bonds’ issuance.

- Designing the prospect and registering it at the National Commission for Financial Market.

- Conducting a communication campaign in order to promote the SOE(s) bonds among potential investors (population, firms, banks, insurance companies etc.).

Medium-term actions/policies

- Defining the list of SOEs to be privatized first, in line with the triage results conducted in 2024 by the Government.

- Conducting the company valuation of these SOEs and designing individual privatization strategies.

- Simplification of listing procedures at the domestic stock exchange.

- Revising the pricing policy of the domestic stock exchange, in order to make it more appealing to small portfolio investors.

- Fostering corporate governance of SOEs:

- Increasing the financial remuneration of SOE board members and attracting independent board members so that their share could reach at least 1/3 of the board.

- Redesigning the PPA role in the management of SOEs, by refocusing its attention from micro-management to fostering the corporate governance of SOEs, preparing the selected SOEs for privatization and increasing the performance of SOEs.

- The focus of the PPA should be on making SOEs grow, under commercial conditions. Any non-commercial function imposed by the Government to SOEs should either be redirected to a public entity (ideal scenario) or be subsidized from the state budget so that fulfilling non-commercial objectives would not undermine the commercial ones and the overall performance of the SOEs.

- Rethinking the policy by which the SOEs are obliged to transfer to the state budget half of their dividends and encouraging the SOEs to reinvest their profits for development.

- Implementing the automatized information system that would digitalize the information about public property.

Long-term actions/policies

- Advancing the restructuring of ”intreprinderi de stat” in “societati de actiuni” of the SOEs, in order to extend the pool of eligible SOEs for bond issuance.

- Conducting the privatization in a transparent manner, under the supervision of development partners and civil society.

- Initiate the listing of minority shares of selected SOEs, after enhancing their transparency, governance and financial position.

- Supporting other SOEs to issue bonds and list on the stock-exchange following the frontrunners (PPA should act as the main advocate in this regard).